20+ Chase mortgage rates

- The Income Tax Rate for Fawn Creek is 57. On Wednesday September 07 2022 the national average 20-year fixed mortgage APR is 6170.

Dec9curoinvestorpres

What percentage of people in poverty lack health insurance coverage in Fawn Creek.

. Save Money With Lowest Rates 2022. The US average is 46. JP Morgan Chase has many fixed rate jumbo mortgage products all at very competitive interest rates.

Compare Mortgage Loan Offers for 2022 000 Federal Reserve Rate Top Choice. Current rates in Chase Maryland are 493 for a 30 year fixed loan 430 for 15 year fixed loan and 469 for a 51 ARM. - Tax Rates can have a.

In Fawn Creek there are 3. See How Much You Can Save. Take the First Step Towards Your Dream Home See If You Qualify.

A fixed 20-year mortgage is a loan lasting for 20 years or 240 monthly payments with an interest rate that stays consistent for the duration of the loan. Ad First Time Home Buyers. 1 day agoThe average rate for a 15-year fixed mortgage is 520 percent up 4 basis points over the last seven days.

Ad Top-Rated Mortgage Companies 2022. Ad Prequalify Online For A Chase Fixed Rate Or Adjustable Rate Mortgage. Ad Todays Best Refinancing Mortgage Rates Curated for Your Needs.

Ad Get an Affordable Mortgage Loan with Award-Winning Client Service. Todays purchase interest rates for your local area. Ad Top-Rated Mortgage Lenders 2022.

Compare Chase Mortgage Rates. Current 30 year conforming mortgage rates from Chase Bank for a home purchase are at 4375 percent. With this mortgage you can expect to have a lower interest.

In 2022 Chase announced that it would pay 115 million as part of a settlement in a class action lawsuit that claimed the. Home Purchase in Chase Maryland. Ad Find The Best Options for Buying a Home.

In 2018 the federal poverty income threshold was 25465 for a family of four with two children and. Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online. Current 20-year mortgage rates.

Chase Sapphire Reserve Chase Sapphire Preferred Vs. 400000 with 20 Down. For example on a 20.

Chase Sapphire Preferred Amex Platinum Vs. Low to Zero Origination Fees. Unlike other lenders that offer balloon-payment jumbo loans Chases large-balance.

The average 20-year refinance APR is 6180. Get Low Home Loan Rates 10 Best Mortgage Lenders Compare Companies Top Online Deals. Tax Rates for Fawn Creek - The Sales Tax Rate for Fawn Creek is 85.

30-year fixed mortgage rates. Based on data compiled by Credible three key mortgage rates for home purchases have risen and one remained unchanged since yesterday. 3 hours agoOn a 30-year jumbo mortgage the average rate is 620 and the average rate on a 51 ARM is 460.

1 day agoA year before the COVID-19 pandemic upended economies across the world the average interest rate for a 30-year fixed-rate mortgage for 2019 was 394. Chase offers fixed-rate mortgages with 10-year 15-year 20-year 25-year and 30-year terms. Ad Prequalify Online For A Chase Fixed Rate Or Adjustable Rate Mortgage.

The US average is 73. In fact Chase Bank mortgage rates and refinance rates are exactly the same right now. A 20-year fixed-rate mortgage refinance of 100000 with todays interest rate of 597 will cost 715 per month in principal.

Chase 15-Year Fixed Mortgage. Monthly payments on a 15-year fixed mortgage at that rate will cost. Ad Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Mount Laurel NJ June 27 2017 Freedom Mortgage Corporation a privately held full-service mortgage lender licensed in all 50 states has agreed to buy approximately. Apply Get Pre Approved. August is the hottest month for Fawn Creek with an average high temperature of 912 which ranks it as about average compared to other places in Kansas.

Please find below mortgage rates offered by Chase based on a 200000 loan amount. Choose The Right Mortgage Loan To Buy Your Dream Home. Check Your Eligibility for a Low Down Payment FHA Loan.

Special Pricing Just a Click Away - Get Started Now See For Yourself. The settlement was announced in 2017.

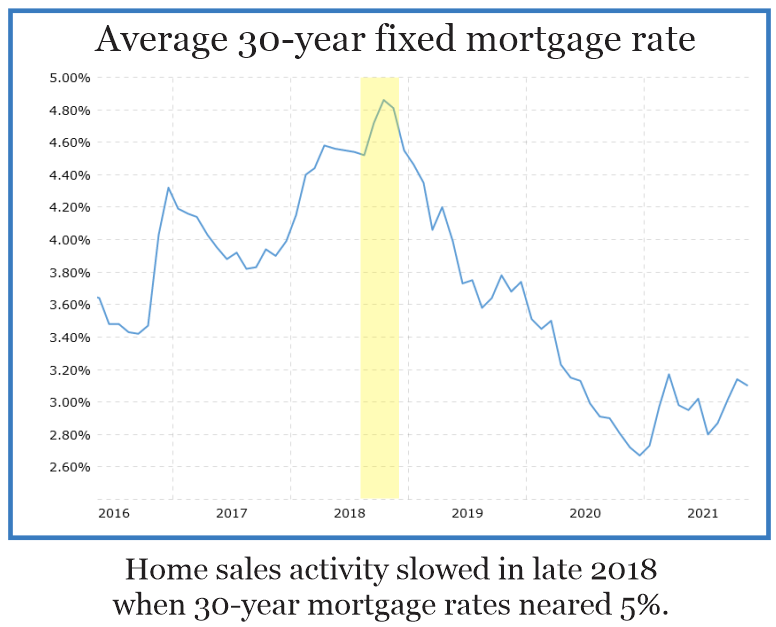

How You Can Beat Rising Mortgage Rates In 2022 Warren Reynolds

Pin On Deck Ideas

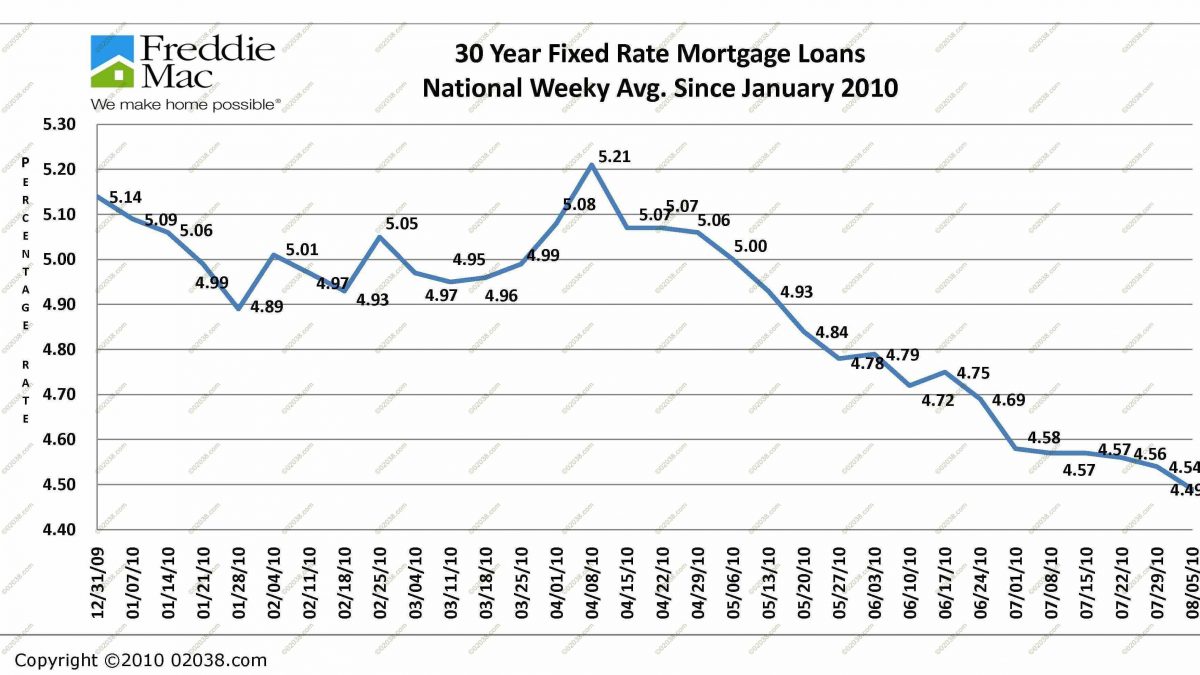

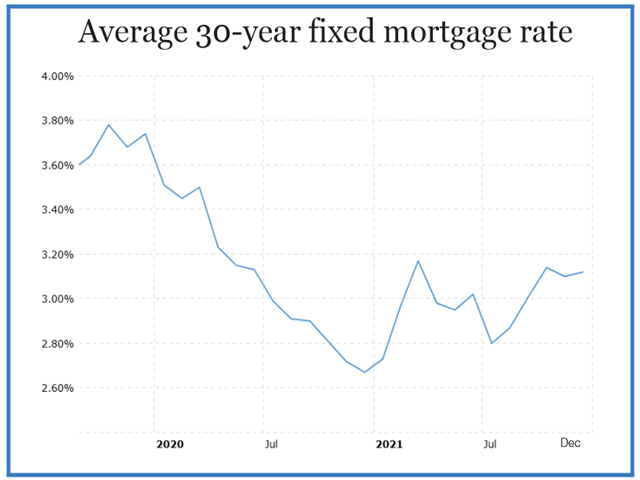

Mortgage Rates At Historic Lows Again 02038 Real Estate

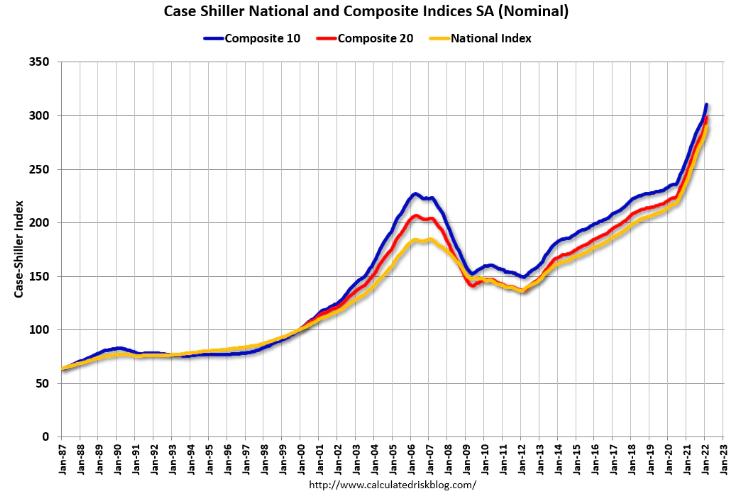

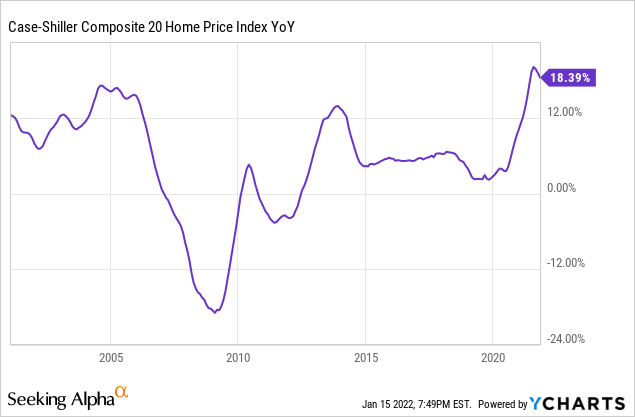

Retiring Worried About A Housing Crash

Retiring Worried About A Housing Crash

/dotdash_Final_Why_Structured_Notes_Might_Not_Be_Right_for_You_Nov_2020-01-eae4f9726a074ae1b50bca26e257d429.jpg)

Why Structured Notes Might Not Be Right For You

Jobless Americans Face Unemployment Benefit Cuts In More Than 20 States Forbes Advisor

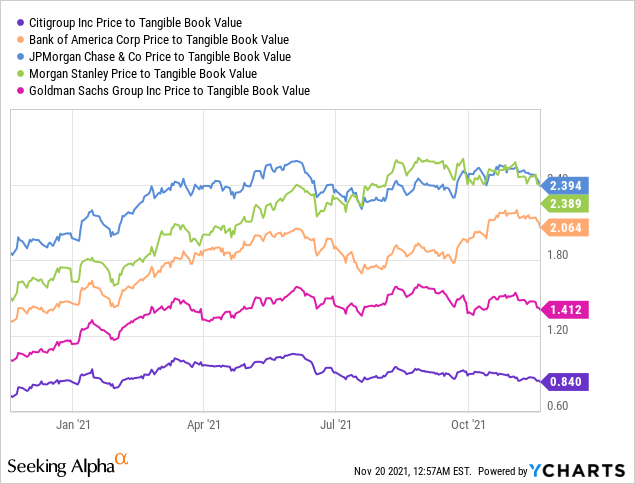

Citigroup Stock A Buy On The Dips Nyse C Seeking Alpha

Dec9curoinvestorpres

Rosewood Patio Deck Designs Decks And Porches Deck Skirting

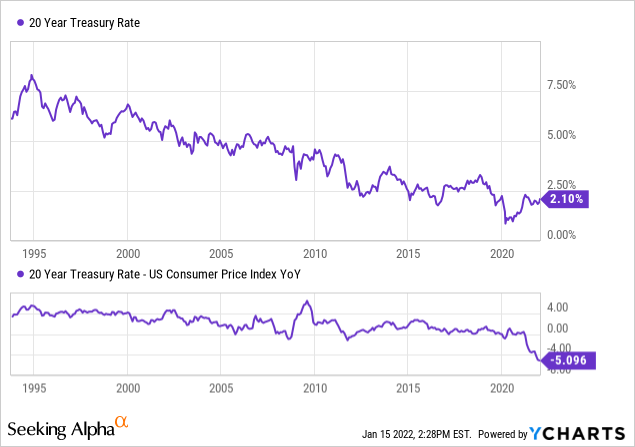

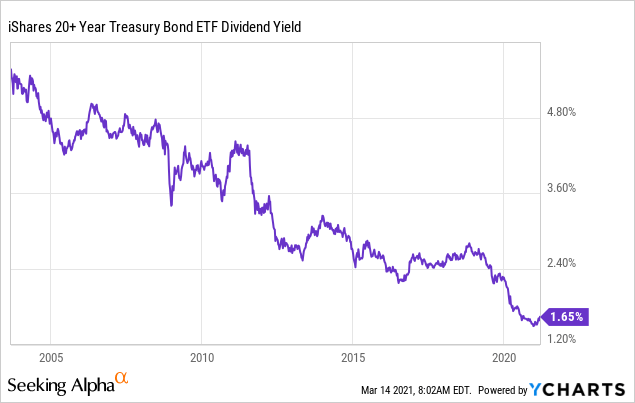

Forget Stock Market Crash Bond Market May Collapse Sell Tlt Seeking Alpha

The Great 2021 Bond Market Collapse Nasdaq Tlt Seeking Alpha

Retiring Worried About A Housing Crash

How You Can Beat Rising Mortgage Rates In 2022 Warren Reynolds

Forget Stock Market Crash Bond Market May Collapse Sell Tlt Seeking Alpha

Retiring Worried About A Housing Crash

Investordaypresentation